As architects, we have a responsiblity to consider the broader issues surrounding the impact of buidins on the built environment. More and more this includes consideration of renewable energy sources to reduce pollution, limit global warming and bring more energ to more people worldwide. Solar Energy has the potential to be a cost efficient renewable energy solution. The use of Solar Energy generates tangible and intangible benefits. The intangible benefits include harnessing the power of a resource that is renewable and sustainable, saving our environmental resources. But Is Solar Power feasible for your small business? OMNIA Group Architects researched the option for our office building, located at 323 S. York Road in Hatboro, Pennsylvania to find out.

First let us review any tax incentives. There is a database of state incentives available at http://www.dsireusa.org/, but at this time, the Commonwealth of Pennsylvania does not offer any incentives.

But in 2004 under Governor Rendell, Pennsylvania passed a law under Act 213, requiring electric generation suppliers to provide a percentage of electricity from alternative, renewable and sustainable sources. Because of this, homeowners or businesses in Pennsylvania can sell their Solar Alternative Energy Credits, Solar AEC, SAEC sometimes called SREC, Solar Renewable Energy Credits adding to the solar option feasibility.

http://www.puc.state.pa.us/consumer_info/electricity/alternative_energy.aspx

These credits represent 1000 kilowatt-hours (KWH) of solar energy generated by any eligible renewable energy source. Currently, according to the Pennsylvania law, investor-owned utilities such as PECO, must offer net metering to any customer that generates electricity. If a solar PV System is installed in a Pennsylvania home or business, the owner can apply for certification in the PA AEPS (Pennsylvania Alternative Energy Portfolio Standard) program, allowing the sale of their renewable solar production credits to improve the economic return of the installation.

The Federal Investment Tax Credit (ITC) allows for a 30% credit on federal income tax returns, allowing credit based on the full cost of the installation. This tax credit is set to expire at the end of 2016, dropping down to 10% in 2017

Another accounting credit for consideration involves the Modified Accelerated Cost Recovery System (MACRS). Under this system, the tax depreciation statistics factor into the Cost/Benefit Analysis but can only be used for businesses, as homeowners are ineligible to utilize this tax credit.

Our first step as building owners, involved contacting a qualified and reputable specialist in the Solar Energy field. A Photo voltaic or PV roof system was recommended. After providing our PECO invoices for the past 6 months to determine our usage, our expert requested an Eagle View Report (aerial map) of our rooftop to establish the dimensions and locations of equipment and utilize that information to determine the correct placement of the PV system. CertainTeed Corporation submitted a Precise Aerial Measurement Report followed by a System Summary detailing their recommendation of a state of the art, 14.9KW Grid Interactive Photovoltaic System, featuring low profile BIPV (Building Integrated Photovoltaic) solar shingles, module Apollo II-60 (60W).

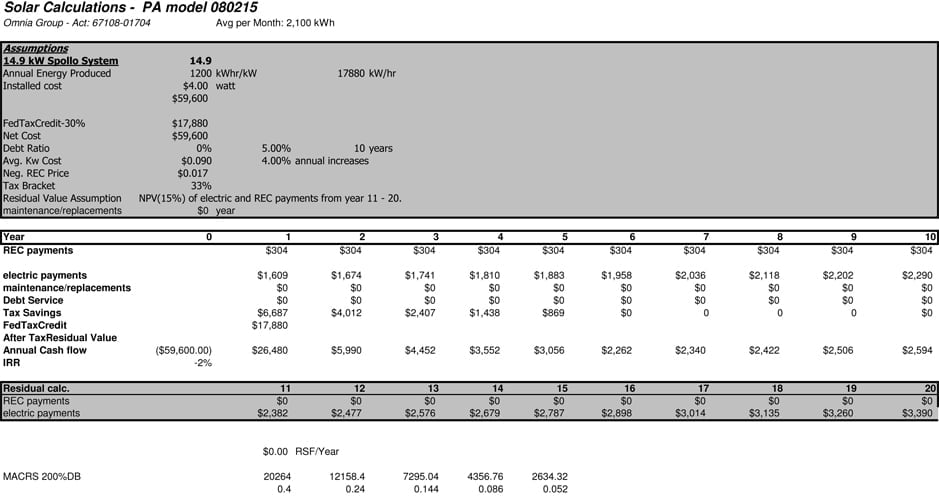

The question of economic viability is answered in the Cost and Payback Pro Forma provided by our expert. Given the low cost of electricity at this time and the current low cost of the SAEC’s (REC payments on our form are credits generated by our proposed system that can be sold to utilities on a contract or a spot market), the internal rate of return on our project projected over a ten (10) year payback.

The total estimated cost of installation, detailing the state of the art solar shingles, approximated at $60,000. All of the accounting and tax credits along with any possibility of selling “SREC” credits factored into the analysis.

Is Solar Power in Pennsylvania right for your small business? At this writing, a brand new state of the art Solar PV System for our office in Pennsylvania is not economically feasible.

As of September 30, 2015, purchasing a Solar PV System remains a capital project for the future, not the present. The OMNIA Group Architects will monitor future data, including the possibility that the current Commonwealth of Pennsylvania, Governor Tom Wolf, will reinstate the Pennsylvania tax incentives for solar energy installation.

OMNIA Group Architects use principles of good design, utilizing websites as dynamic engines to perfect our programs. A great architect adds more value to your design and helps you to maximize your budget. Selecting a professional architect/designer produces and inspires the use of the architectural space. We are committed to creativity and good design.